Advertisements

Detailed article on How to Get Your TIN, Verify Your TIN, Business TIN Registration and How to Submit It to Your Bank in Nigeria can be found here on Ejes Gist News.

Banks across Nigeria have commenced stricter enforcement of Tax Identification Number (TIN) requirements following recent reforms under the Nigeria Tax Administration Act 2025. The new framework strengthens tax administration and requires individuals and businesses to link a valid TIN to their bank accounts to enable seamless financial transactions, regulatory compliance, and proper tax records.

For many Nigerians, the renewed enforcement has raised urgent questions about how to get your TIN, how to verify your TIN, and how to submit your TIN to your bank without delays. This guide provides a comprehensive, step-by-step explanation using official Joint Tax Board (JTB) portals and bank-approved channels.

Advertisements

Why Banks Are Enforcing TIN Submission

Ejes Gist News reports that Nigerian banks began intensified customer outreach after regulatory directives tied to the Nigeria Tax Administration Act 2025. The law mandates the integration of TINs with bank accounts to improve transparency, prevent tax evasion, and harmonise taxpayer data nationwide.

Under the new enforcement:

Advertisements

- Customers without a linked TIN may face transaction restrictions.

- Corporate and individual accounts must provide valid TIN details.

- Banks are required to update Know Your Customer (KYC) records with verified tax information.

What Is a Tax Identification Number (TIN)?

A Tax Identification Number is a unique number issued by the Joint Tax Board through the Federal Inland Revenue Service (FIRS) and State Internal Revenue Services. It identifies taxpayers across Nigeria and applies to:

- Individuals

- Sole proprietors

- Partnerships

- Registered companies and corporate organisations

Understanding how to get TIN, how to get tin number in Nigeria, and how to get tin number online is now essential for banking, tax filing, and corporate compliance.

How to Get Your TIN in Nigeria (Individuals)

Many Nigerians searching for how to get your TIN or how to get tin number in nigeria online can now complete the process fully online.

Step-by-Step: How to Register for TIN as an Individual

- Visit the official Joint Tax Board Individual Registration Portal:

https://tin.jtb.gov.ng/TinIndividualRequestExternal - Select Individual TIN Registration.

- Enter required details:

- National Identification Number (NIN) or Bank Verification Number (BVN)

- Full name

- Date of birth

- Contact details

- Submit the form and generate a Request ID.

- Track approval and receive your TIN electronically.

This process answers common queries such as how to register for tin, how to get tin number after registration, and how to get tin number with request id.

How to Get TIN Number Online in Nigeria for Businesses

Business owners frequently ask how to get tin number for business or how to get tin number in Nigeria for corporate accounts.

Step-by-Step: Corporate TIN Registration

- Visit the JTB Non-Individual Registration Portal:

https://tin.jtb.gov.ng/TinRequestExternal - Select Non-Individual / Corporate Organisation.

- Enter required details:

- Company name

- CAC Registration Number

- Incorporation date

- Business address

- Submit the application and receive a Request ID.

- Your TIN is issued upon verification.

This method also applies to those searching for how to get tin number online and how to get tin number after registration for companies.

How to Verify Your TIN in Nigeria

If you already registered but cannot remember your number, learning how to verify your TIN is crucial.

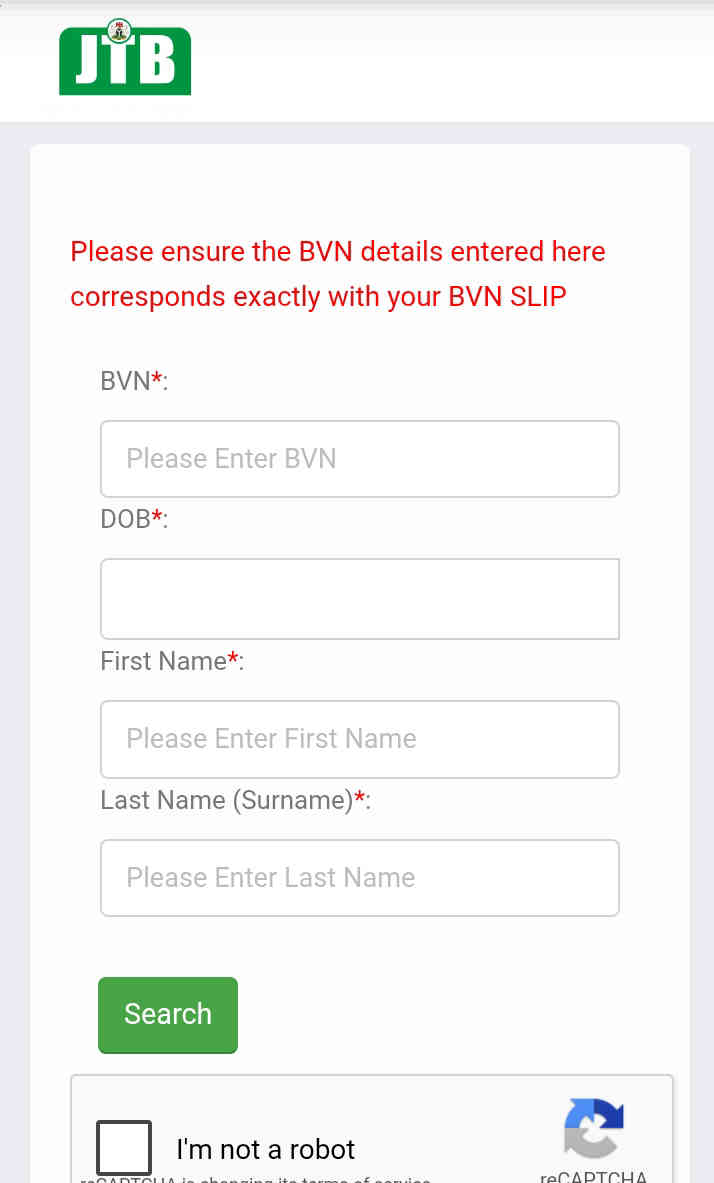

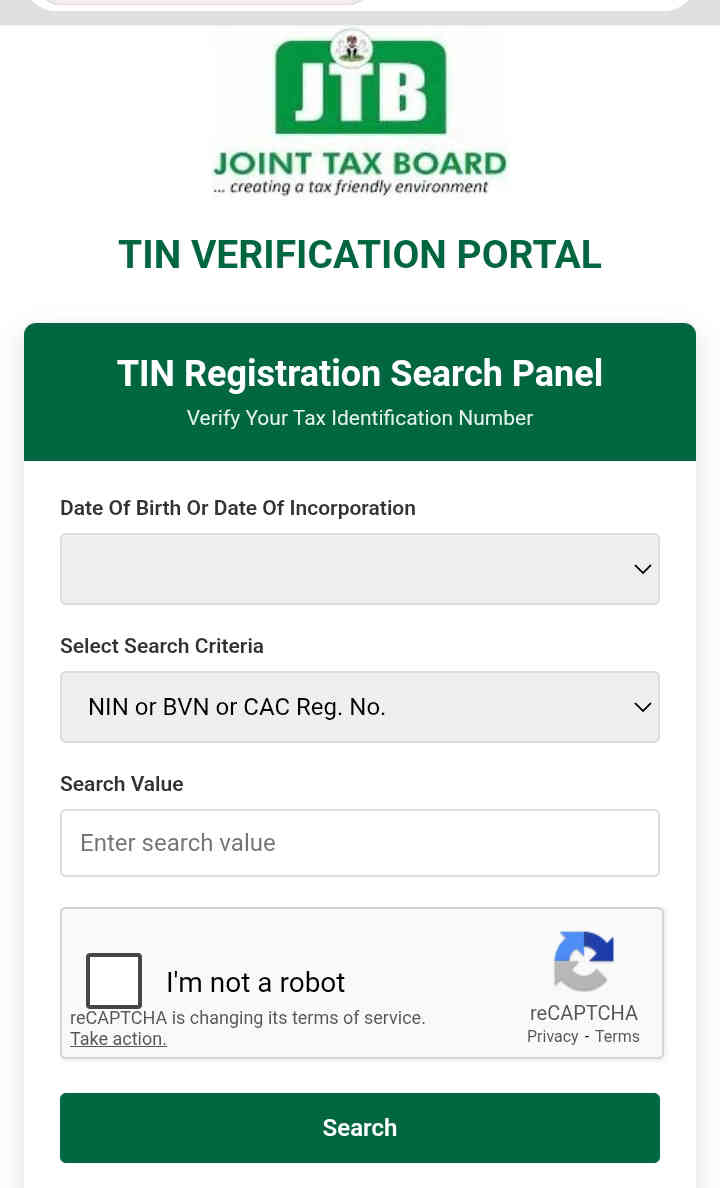

Step-by-Step: How to Verify TIN

- Visit the Joint Tax Board TIN Verification Portal:

https://tinverification.jtb.gov.ng/ - Select a search option:

- NIN

- BVN

- CAC Registration Number

- Enter your Date of Birth (individuals) or Date of Incorporation (companies).

- Complete the CAPTCHA verification.

- Click Search to retrieve your TIN.

This process directly addresses:

- How to verify your TIN

- How to verify TIN

- How to get your TIN if forgotten

Special Note for Companies with Existing TINs

For registered companies, verification is straightforward. If your CAC number is, for example, 198653, you must input it as:

RC198653

The system automatically recognises the format and retrieves the company’s TIN. This step is critical for businesses learning how to verify TIN and how to get tin number for business records.

How to Get Tin Number in Lagos and Other States

The TIN system is nationwide and unified. Whether you are in Lagos, Abuja, Port Harcourt, or any other state:

- The same JTB portals apply.

- State of residence does not restrict registration.

This answers frequent searches such as how to get tin number in lagos, how to get tin number in Nigeria, and how to get tin number online without visiting a tax office.

How to Submit Your TIN to Your Bank

Once you have completed how to get your TIN or how to verify your TIN, the next step is submission.

Bank-Approved Channels for TIN Submission

Banks, including Sterling Bank, have provided multiple channels:

- Online KYC portal (example: sterling.ng/kyc)

- Physical branch submission

- Email submission using official bank contact addresses

Customers are advised to use only official bank channels to avoid data compromise.

Why TIN Linking Matters for Bank Customers

Banks explain that TIN linkage:

- Enables uninterrupted transactions

- Ensures regulatory compliance

- Aligns customer accounts with national tax records

Failure to comply may affect transfers, withdrawals, or account services.

Common Questions Nigerians Are Asking

How to get tin number in Nigeria online?

Use the official JTB portals for individual or corporate registration.

How to get tin number after registration?

Track your Request ID or verify your details through the TIN verification portal.

How to get tin number with request id?

Enter your Request ID on the registration portal to retrieve your assigned TIN.

How to get TIN for business accounts?

Register through the non-individual JTB portal using your CAC details.

Official JTB Portals at a Glance

- Individual TIN Registration:

https://tin.jtb.gov.ng/TinIndividualRequestExternal - Corporate / Non-Individual Registration:

https://tin.jtb.gov.ng/TinRequestExternal - TIN Verification:

https://tinverification.jtb.gov.ng/

These platforms are the only recognised channels for those seeking how to get your TIN, how to verify your TIN, and how to register for tin in Nigeria.

Compliance Reminder

Customers should ensure:

- Names on bank records match TIN records.

- Dates of birth or incorporation are accurate.

- Submissions are completed promptly to avoid service disruptions.

Banks have emphasised flexibility in submission channels, but compliance remains mandatory under the Nigeria Tax Administration Act 2025.

To obtain TIN